define apr in corporate finance

Its helpful to consider two main things about how APR works. A loan is a sum of money that one or more individuals or companies borrow from banks or other financial institutions so as to financially manage planned or unplanned events.

Accounting Taxation Working Capital Management Full Info Capital Requirement Operating Cycle Gross Financial Management Management Financial Accounting

When you borrow money any interest you pay raises the cost of the things you buy with that money.

. Annual Percentage Rate APR is the interest charged for borrowing that represents the actual yearly cost of the loan expressed as a percentage. A corporate financing committee develops policies concerning public equity and debt. Of Periods 1.

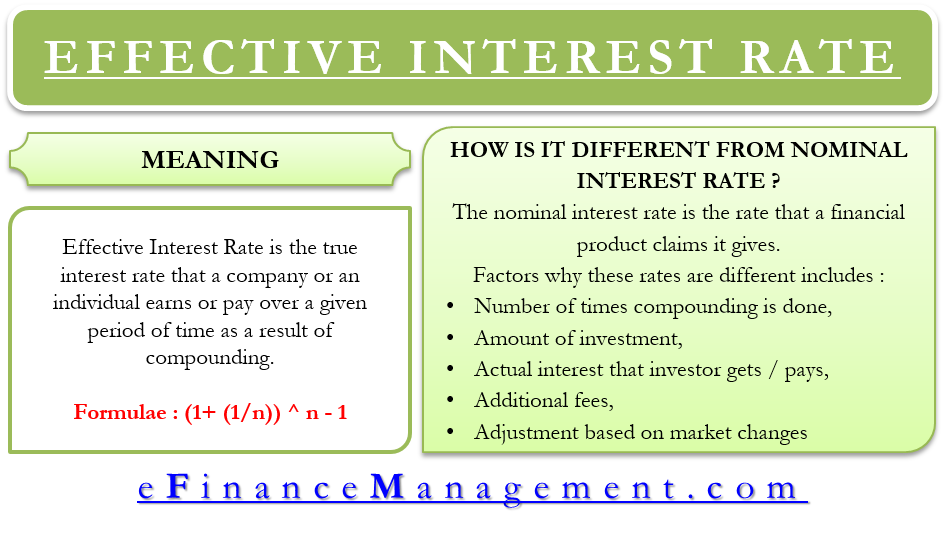

The Effective Annual Rate EAR is the rate of interest Interest Expense Interest expense arises out of a company that finances through debt or capital leases. It is the measure of an investments annual growth rate over time with the effect of compounding taken into account. To use APR you dont need to understand the math behind it but you can always dig deeper and learn how to.

Annual Percentage Rate APR is the interest charged for borrowing that represents the actual yearly cost of the loan expressed. APR stands for annual percentage rate. APR which stands for annual percentage rate is the yearly cost of borrowing money.

1 Essentially it gives you an idea of how much a loan will cost you. - Definition and Concept Perpetuity is a very important concept in corporate finance. Maharashtra State Board HSC Commerce 12th Board Exam.

A regulatory group that reviews documentation that is submitted by underwriters. Annual Percentage Rate APR is the interest charged for borrowing that represents the actual yearly cost of the loan expressed as a percentage. Finance is then often divided into the following broad categories.

Check out this guide for a better understanding of how APR works and the effect it has on credit card interest. Advertisement Remove all ads. APR represented as a percentage of the loan balance.

The annual percentage rate APR is the amount of interest on your total mortgage loan amount that youll pay annually averaged over the full term of the loan. A lower APR could translate to lower monthly mortgage payments. The annual percentage yield APY is a normalized interest rate.

The VOC was also the first recorded joint-stock company to get a fixed capital stock. We have 108 other definitions for EIR. Interest is found in the income statement but can also actually earned on an investment or paid on a loan as a result of compounding the interest over a given period of time.

What is the Effective Annual Rate. APR is an annualized representation of your interest rate. MCQ Online Tests 99.

Finance is a term for the management creation and study of money and investments. When deciding between credit cards APR can help you compare how expensive a transaction will be on each one. Question Bank Solutions 13302.

This is calculated before compounding interest is taken into account. Its different from the interest rate in that it not only includes interest costs but also fees related to a loan. The total amount of interest to be paid is based on the original amount loaned or the principal and is represented in.

Annual Percentage Rate The business finance term and definition APR represents the yearly real cost of a loan including all interest and fees. Youll see APRs alongside interest rates. Corporate Financing Committee.

In doing so the borrower incurs a debt which he has to pay back with interest and within a given period of time. Ektachrome Infrared Film Kodak EIR. Engineering Information Release development standards showing only Business Finance definitions show all 53 definitions Note.

The concept of perpetuity makes it possible to value stocks real. Where lenders relate total interest charges on INSTALMENT CREDIT loans to the original amount. APR the annualized percentage rate of INTEREST charged on a LOANThe APR rate will depend on the total charge for credit applied by the lender and will be influenced by such factors as the general level of INTEREST RATES and the nature and duration of the loan.

How its applied and how its calculated. The Dutch East India Company also known by the abbreviation VOC in Dutch was the first publicly listed company ever to pay regular dividends. Based on the compounding period of one year.

The APY provides a standardized representation of the underlying interest rates of financial products. Define annual percentage rate APR and annual percentage yield APY 5-23 You are responsible for managing your companys short-term investments and you know that compounding frequency of investment opportunities is quite important. The annual percentage rate APR of a loan is the total amount of interest you pay each year.

It is often used to measure and compare the past performance of investments or to project their expected future returns. Corporate finance for the pre-industrial world began to emerge in the Italian city-states and the low countries of Europe from the 15th century. Interest Rate An interest rate refers to the amount charged by a lender to a borrower for any form of debt given generally expressed as a percentage of the principal.

Specifically it deals with the questions of how an individual company or government acquires money called capital in the context of a business and how they spend or invest that money. Concept Notes Videos 271. The CAGR formula is equal to Ending ValueBeginning Value 1No.

Mortgage Apr Vs Interest Rate Infographics Here We Provide You With The Top 5 Differences Between Mortg Vertical Integration Mortgage Marketing Mortgage Payoff

Effective Interest Rate Meaning Formula Importance And More

What Is Bookkeeping Accounting And Finance Budgeting Money Personal Finance

0 Response to "define apr in corporate finance"

Post a Comment